How to File an Insurance Claim for Your Roof

Filing an insurance claim for a new roof can be stressful especially if it’s following a severe and destructive storm. Although dealing with the insurance company can be a daunting task, it doesn’t have to be. With the right preparation and knowledge, you can navigate the process smoothly and get the settlement you need to repair or replace your damaged roof. If you’ve experienced a damaging storm, it’s important to file a claim as soon as possible. There may be several other homeowners filing a claim at the same time and waiting too long could put you at the end of a long waiting list. The following are steps to take when filing an insurance claim for your roof.

1 – Review What Your Policy Covers

The first step in filing an insurance claim for a new roof is to review your insurance policy. Make sure you understand the coverage provided and the process for filing a claim under your specific insurance. Some policies have requirements or limitations on coverage, so it’s important to know what to expect. There are different ways your roof can be damaged so make sure your policy covers all types of roof damage. There’s no use going to your insurance company if you don’t have coverage for the damage your roof suffered.

2 – Inspect the Damage

You need to check out the damage to your roof and the rest of your house while you’re at it to report all damages to your insurer. It’s most likely too dangerous for you to get up on the roof yourself so it’s best to hire a local roofing contractor to assess the damage. They can go up there themselves or use a drone to survey the area. Try to find a roofing company that will not only inspect your roof but also have certified public adjusters that can help your through the whole process of filing a claim and finishing the project.

3 – Document the Roof Damage

You need to take pictures of the damage once you know there is damage to the roof. You need to give your insurer pictures and detailed documents so your claim can be validated. It’s always a good idea to have pictures of the entire exterior of your home before any damages happen so you can prove that the damages you’re filing for are indeed current. Be sure to take pictures of the inside of your home as well if there was any interior damage. A roofing company can safely take pictures for you if you hired a company to inspect your roof.

4 – Protect Your Home

If your roof or part of your roof has been ripped off by a storm; it leaves your home vulnerable to the elements. You’ll need to have the roof covered with a tarp to prevent further damage. Your insurance policy may actually require you to protect your home from any further damage because they might not cover damage that happens after the initial storm or accident. Make sure to keep any receipts for temporary repairs you made to protect your house. These receipts will be important when you file your claim and will help support your case.

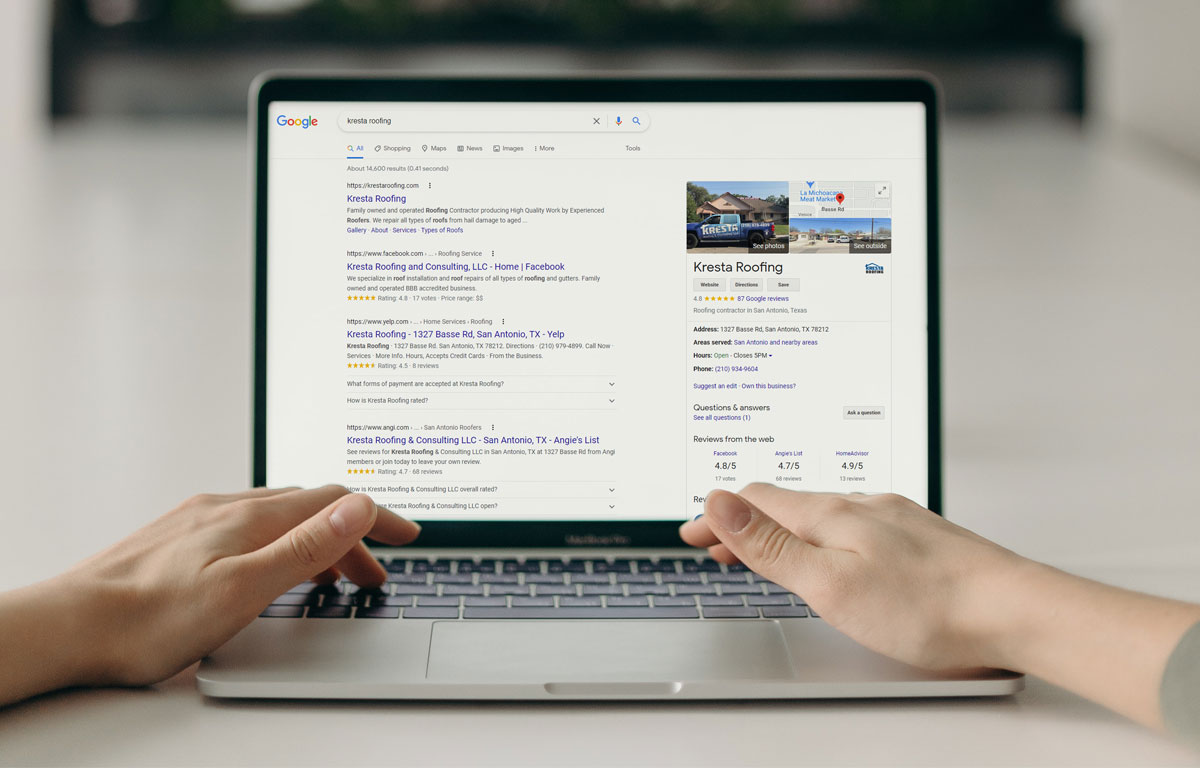

5 – Find A Local Roofing Company

Now is the time to locate a local roofing contractor or if you already found one that inspected and photographed your roof; ask them for a written estimate for the cost of working on your roof. If your roof needs to be completely replaced, make sure the contractor makes a detailed report as to why a replacement is necessary as opposed to a simple repair.

6 – File Your Claim

Once you have the necessary documentation, contact your insurance company to report the damage and initiate the claim process. Make sure to do this as soon as possible to get the ball rolling on your new roof and there also may be a time limit to file depending on your policy. Make sure to include all reports, pictures, receipts and estimated cost of any interior damage as well to your insurer for the claim. Also let them know if you are still safely able to live in your home in the current condition or if you need to find another place to live during the repairs. Provide an estimated cost for this as well.

7 – Meet the Insurance Adjuster

The insurance company will take all documents and pictures into account and then schedule an inspection of the damage with their own insurance adjuster. This is an important step as they will determine the extent of the damage and the cost of repairs or replacement. During the visit, the adjuster will inspect your house and take their own photos of the damage. If possible, have your chosen roofing contractor present during the adjuster’s inspection so they can discuss what needs to be done. Once the inspection is complete, the insurance company will provide you with a claim settlement offer. Review the offer carefully and negotiate if necessary.

8 – Hire a Roofing Company

Hire a reputable local roofing contractor to repair or replace your roof once the claim has been approved and you are satisfied with the claim settlement. Work with the contractor and the insurance company to ensure that the repairs are made according to the settlement agreement and that the insurance company covers the cost of the repairs. Ask for pictures of the new roof or repairs for your records.

Filing an insurance claim can be a complicated process, but proper documentation and assistance can make the process much easier. Don’t hesitate to ask your insurance company any questions you may have, or seek professional help if needed. Have you experienced strong winds, hail, or severe storms that have damaged your roof? Call Kresta today for a free roof inspection, photos, and estimate for your insurance claim. We have licensed insurance adjusters on staff that can help you through the claim process and take the stress off your shoulders.